michigan sales tax exemption number

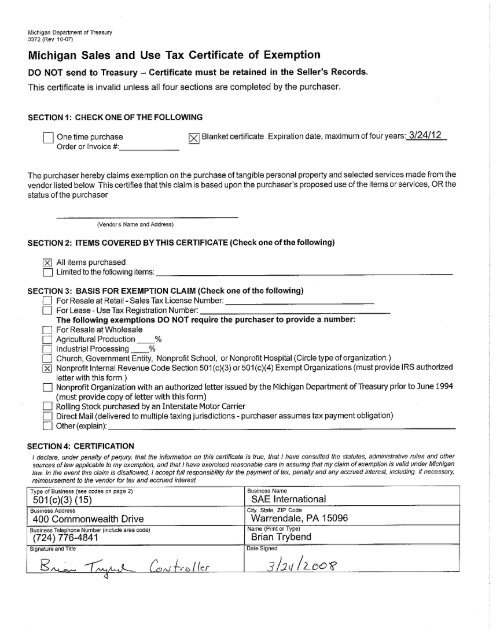

The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption. Sell tangible personal property to the end user from a Michigan location wholesalers do not need to register.

Michigan Sales And Use Tax Certificate Of Exemption

DO NOT send to.

. How to fill out the Michigan Sales and Use Tax Certificate of Exemption Form 3372 Filling out the 3372 is pretty straightforward but is critical for the seller to gather all the. Get Access to the Largest Online Library of Legal Forms for Any State. 3372 Michigan Sales and Use Tax Certificate of Exemption Author.

Ad Download or Email MI DoT 3372 More Fillable Forms Register and Subscribe Now. 3372 Michigan Sales and Use Tax Certificate of Exemption. To claim exemption from Michigan sales or use tax that contractor must provide a completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption and provide a copy of Form.

Sales Use and Withholding Tax Due Dates. Enter Sales Tax License. Michigan Department of Treasury Subject.

This page discusses various sales tax exemptions in Michigan. 09-18 Michigan Sales and Use Tax Certificate of Exemption. Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now.

Register for Sales Tax if you. Michigan is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. Michigan Department of Treasury Subject.

Up to 2 cash back 2. The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account. Churches Sales to organized churches or houses of religious worship are exempt from sales.

BASIS FOR EXEMPTION CLAIM Check one of the following. Verification of tax-exempt resale certificate can be carried out through the official Alabama State website. Michigan Department of Treasury 3372 Rev.

Enter Use Tax Registration Number. Ad Sales Tax Exemption Michigan Wholesale License Reseller Permit Businesses Registration. The following exemptions DO NOT require the purchaser to provide a number.

3372 Michigan Sales and Use Tax Certificate of Exemption Keywords 3372. Ad The Leading Online Publisher of Michigan-specific Legal Documents. Sales Tax Exemption Michigan Simple Online Application.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. 3372 Michigan Sales and Use Tax Certificate of Exemption Keywords 3372. 3372 Michigan Sales and Use Tax Certificate of Exemption Author.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. 11-09 Michigan Sales and Use Tax Certificate of Exemption. Enter Sales Tax License Number.

Streamlined Sales and Use Tax Project. For Resale at Retail. Ad Sales Tax Exemption Michigan Wholesale License Reseller Permit Businesses Registration.

Michigan Department of Treasury Form 3372 Rev. Q For Resale at Retail. Sales Tax Exemption Michigan Simple Online Application.

Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be. Sales Tax for Concessionaires If you will make. 3372 Michigan Sales and Use Tax Certificate of Exemption.

Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers who will Register and Title their Vehicle in Another State or Country.

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com